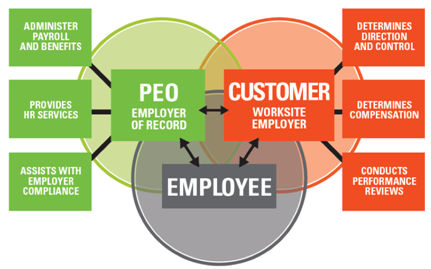

3KC’s payrolling solutions enable companies to efficiently and cost-effectively engage, pay and manage the talent they need while mitigating risks associated with outsourcing and/or misclassification of resources. Our payrolling solutions are designed to reduce and manage costs of your contingent workforce and provide the ability to assess pre-identified talent on the job before hiring. Our payroll service solution is simple. You identify the candidate or workforce you wish to engage, and then those candidates or workers are connected with 3KC. Through 3KC’s streamlined on-boarding process, 3KC becomes the employer or agent of record and handles time-keeping, payroll, benefit administration, taxes, insurance, and employer liabilities. Each employee receives a weekly paycheck and enjoys benefits, while you receive a single invoice for the entire workforce along with custom account management dashboard.

IC COMPLIANCE SERVICES

3 Key is a good partner to help companies reduce risks associated with misclassification of W2 employees as 1099 independent contractors. As companies increase the size of their contingent workforce, they face many new risks. Federal and state-specific laws govern the relationship between companies and contract workers. For example, in California, companies and staffing agencies are considered co-employers and share liability in all employment law violations. It’s important that you know your contingent workers are classified correctly. Unintentionally misclassifying a consultant either by the company or its staffing agencies can result in a chain reaction of violations and fines including penalties, back taxes, interested, retroactive benefits, worker’s compensation penalties, etc. 3KC’s verification and payrolling services are exceptional and a good insurance policy for our clients.

Benefits of 3KC’s Payrolling Services include:

- “Flat” and “Statutory Only” pricing is available.

- Rate optimization across your contingent workforce program reduces costs.

- Conversion of long-term contingent workers at a reduced rate structure.

- Seamless transitions of incumbent supplier contingent worker populations

- Increased visibility of contingent workforce utilization

- Centralized processes, timekeeping, billing, payment, and accountability

- Increased compliance and co-employment risk mitigation

- Streamlined pre-employment screening, screening compliance, and validation.

- Administration of all payroll, benefits, taxes, workers compensation, insurance, and reporting.

- Project or seasonal workforce needs requiring a flexible workforce solution

- Previewing employees prior to adding them to corporate headcount and payroll.

- Retaining the talents of key personnel and returning retirees on a contract/temporary basis

- Access to benefits such as group health, dental, vision, and 401K plans

HOW IT WORKS

Professional Employer Organization (PEO) provides HR administration services when you already know who the resources you wish to engage with are – a referred resource, an existing consultant, alumni, retiree, or other pre-identified workers – we provide the means for you to indirectly work with these resources. From IC compliance to administration of benefits to payroll administration, we handle it all.